The Reshoring Paradox, A&D Needs China, Deal Headlines

Can American Reshoring Work?

A few excerpts from a great post from Rahul Bhushan’s latest Substack.

“The other question is whether all this is even going to be worth it for America.

We know the goal: to reshore critical industries, secure supply chains, and reduce dependency on strategic rivals. The U.S. wants to make more things at home—semiconductors, EV batteries, pharmaceuticals, steel. It wants to create jobs, build capacity, and reclaim control.

But whether that’s possible—let alone profitable—is another matter.

U.S. manufacturing has been in structural decline for decades. There are 12.7 million manufacturing workers today, down from nearly 20 million at the sector’s peak in 1979. Manufacturing’s share of GDP has fallen from 25% in the 1950s to 10% today.

By comparison, China accounts for 35% of global manufacturing output—more than the U.S., Japan, Germany, India, and South Korea combined.

This didn’t happen by accident. China built a manufacturing base that is now world-class in both scale and sophistication. Over two decades, it has developed supply chain ecosystems so dense and integrated that they are almost impossible to replicate. In sectors like EVs, batteries, and advanced electronics, Chinese capacity now outpaces global demand. And thanks to massive state-backed financing, it continues to build faster than anyone else.

And yet, there are signs of progress.

Since January 2021, the U.S. has added roughly 775,000 manufacturing jobs to the economy. Construction spending on new factories hit a record $235 billion in 2024. Reshoring mentions on S&P 500 earnings calls are up 128%. Foreign companies have pledged $1.6 trillion in U.S. investments since the start of the year.

Supporters argue the benefits go far beyond jobs. Every dollar in manufacturing output adds $2.79 to the broader economy. Every new manufacturing job creates between seven and twelve jobs downstream. The sector accounts for 70% of U.S. R&D spending, 55% of new patents, and a third of productivity growth.

So the case for reshoring isn’t weak. But it is complicated.

One problem is that policy volatility cuts against long-term investment. When trade rules change on a whim, capital stays on the sidelines. Ironically, the uncertainty introduced by the White House is making the U.S. a harder place to invest, not an easier one.

There’s also the question of inputs. Nearly half of U.S. imports are intermediate goods—things American manufacturers need to produce finished products. Blanket tariffs don’t just hurt foreign competitors—they raise costs for domestic producers too. And now, the stakes are even higher: over the weekend, China halted rare earth exports to the U.S.—a direct blow to critical input supply chains for advanced manufacturing and defense.

Then, there’s the issue of time. You can’t relocate industrial ecosystems overnight. These aren’t software teams or data centres. Advanced manufacturing takes years—sometimes decades—to rebuild. And the U.S. is trying to do it under compressed timelines and with unclear rules.

Nevertheless, the logic for reshoring is strong—especially in strategic sectors. The pandemic revealed just how brittle global supply chains are. The geopolitics of today only reinforce that lesson.

So, can American reshoring be successful? Yes—but only if the politics start to look more like strategy than spectacle.”

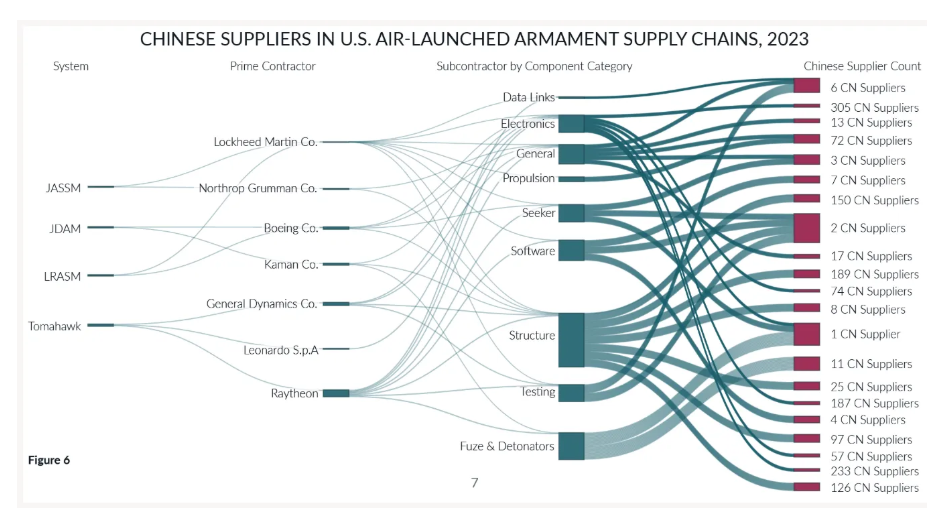

Aerospace & Defense Supply Chains + China

Weapons systems simply cannot get built without Chinese suppliers.

And most everything else of critical importance doesn’t get built without rare earths & magnets.

And given China has already (since 2022) been shifting its exports away from developed countries and more towards developing countries, it stands to reason their pain threshold for an extended tariff war is higher than some people anticipate.